Personal finance encompasses a wide array of financial activities and decisions that individuals make throughout their lives. At its core, it involves managing one’s income, expenses, savings, investments, and debt to achieve financial stability and security. Understanding the basics of personal finance is crucial for anyone looking to navigate the complexities of financial life.

This foundational knowledge includes grasping concepts such as budgeting, saving, investing, and the implications of debt. Each of these elements plays a significant role in shaping an individual’s financial health and future. One of the first steps in mastering personal finance is recognizing the importance of cash flow management.

Cash flow refers to the movement of money in and out of an individual’s finances. A positive cash flow indicates that income exceeds expenses, allowing for savings and investments. Conversely, a negative cash flow can lead to financial distress and increased debt.

By tracking income sources and expenditures, individuals can gain insights into their spending habits and identify areas where they can cut back or allocate funds more effectively. This awareness is essential for making informed financial decisions that align with one’s long-term goals.

Key Takeaways

- Personal finance involves managing your money, budgeting, and understanding financial concepts.

- Setting financial goals and creating a budget can help you track your spending and save for the future.

- Managing student loans and debt requires understanding repayment options and creating a plan to pay off debt.

- Building and maintaining good credit is important for future financial opportunities and can be achieved through responsible borrowing and timely payments.

- Investing and saving for the future can help you build wealth and achieve long-term financial security.

Setting Financial Goals and Budgeting

Setting financial goals is a critical component of personal finance that provides direction and motivation. Goals can be short-term, such as saving for a vacation or paying off a credit card, or long-term, like buying a home or planning for retirement. Establishing clear, measurable, and achievable goals allows individuals to create a roadmap for their financial journey.

For instance, someone aiming to save for a down payment on a house might set a goal to save a specific amount each month over a defined period. This approach not only clarifies priorities but also fosters a sense of accomplishment as milestones are reached. Budgeting is the practical application of financial goal-setting.

A budget serves as a financial plan that outlines expected income and expenses over a certain timeframe, typically monthly. By categorizing expenses into fixed (like rent or mortgage payments) and variable (such as entertainment or dining out), individuals can better understand their spending patterns. This understanding enables them to allocate funds toward their goals while ensuring that essential expenses are covered.

For example, someone might decide to limit discretionary spending in order to increase their savings rate, thereby accelerating their progress toward their financial objectives.

Managing Student Loans and Debt

For many individuals, student loans represent a significant financial burden that can impact their overall financial health for years to come. Understanding the types of student loans available—federal versus private—and their respective terms is essential for effective management. Federal loans often come with benefits such as lower interest rates and flexible repayment options, while private loans may have variable rates and less favorable terms.

It is crucial for borrowers to familiarize themselves with their loan agreements, including interest rates, repayment schedules, and any potential deferment or forbearance options. In addition to understanding student loans, managing overall debt is vital for maintaining financial stability. High levels of debt can lead to stress and limit an individual’s ability to save or invest for the future.

One effective strategy for managing debt is the debt snowball method, which involves paying off smaller debts first while making minimum payments on larger debts. This approach can provide psychological benefits by creating a sense of accomplishment as debts are eliminated. Alternatively, the debt avalanche method focuses on paying off debts with the highest interest rates first, ultimately saving money on interest payments over time.

Both strategies require discipline and commitment but can lead to improved financial health.

Building and Maintaining Good Credit

| Metrics | Description |

|---|---|

| Credit Score | A numerical representation of an individual’s creditworthiness based on credit history |

| Payment History | A record of on-time or late payments on credit accounts |

| Credit Utilization | The ratio of credit used to credit available, which can impact credit score |

| Length of Credit History | The average age of credit accounts, which can impact credit score |

| New Credit | The number of recently opened credit accounts, which can impact credit score |

| Credit Inquiries | The number of times a credit report is accessed, which can impact credit score |

Credit plays a pivotal role in personal finance, influencing everything from loan approvals to interest rates on mortgages and credit cards. A good credit score is indicative of responsible borrowing behavior and can open doors to better financial opportunities. Understanding how credit scores are calculated is essential for anyone looking to build or maintain good credit.

Factors such as payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent inquiries all contribute to an individual’s credit score. To build good credit, individuals should prioritize making timely payments on all debts and bills. Setting up automatic payments or reminders can help ensure that deadlines are met consistently.

Additionally, keeping credit utilization below 30%—the ratio of current credit card balances to total credit limits—can positively impact credit scores. Regularly reviewing credit reports for errors or discrepancies is also crucial; individuals are entitled to one free credit report per year from each of the three major credit bureaus. By addressing any inaccuracies promptly, individuals can safeguard their credit standing.

Investing and Saving for the Future

Investing is a powerful tool for building wealth over time and achieving long-term financial goals. Unlike saving, which typically involves setting aside money in low-risk accounts like savings accounts or certificates of deposit (CDs), investing involves purchasing assets such as stocks, bonds, or real estate with the expectation that they will appreciate in value over time. Understanding the different types of investment vehicles available is essential for making informed decisions that align with one’s risk tolerance and financial objectives.

For those new to investing, starting with retirement accounts such as 401(k)s or IRAs can be an effective strategy. These accounts often come with tax advantages that can enhance long-term growth potential. For example, contributions to traditional IRAs may be tax-deductible, while Roth IRAs allow for tax-free withdrawals in retirement.

Additionally, diversifying investments across various asset classes can help mitigate risk while maximizing potential returns. Individuals should also consider their investment horizon; younger investors may opt for more aggressive portfolios with higher equity exposure, while those nearing retirement might prioritize capital preservation through bonds or other fixed-income investments.

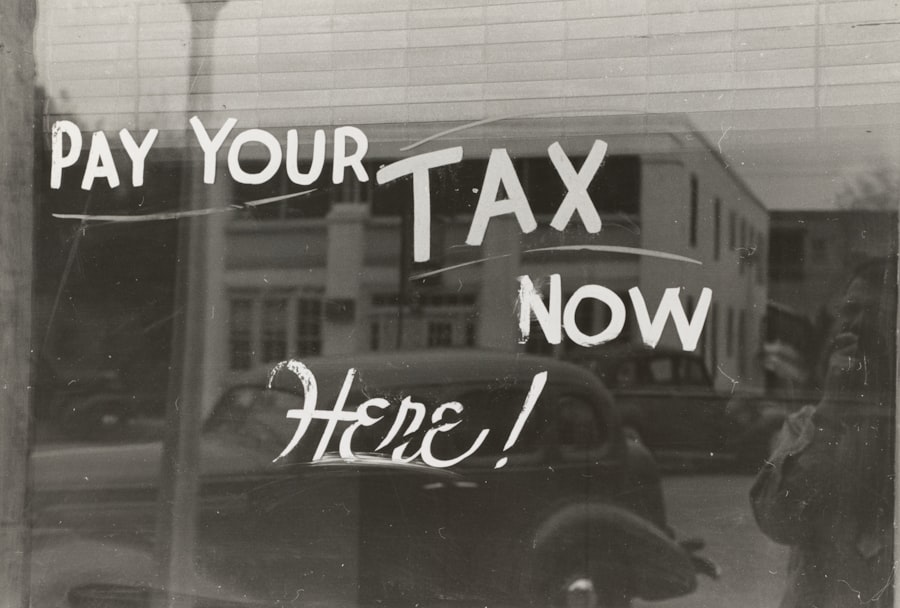

Understanding Taxes and Financial Responsibility

Taxes are an inevitable aspect of personal finance that can significantly impact an individual’s financial situation. Understanding the various types of taxes—such as income tax, capital gains tax, property tax, and sales tax—is essential for effective financial planning. Each type of tax has its own implications for income and investments, making it crucial for individuals to stay informed about current tax laws and regulations.

Financial responsibility extends beyond merely paying taxes; it involves strategic planning to minimize tax liabilities legally. Utilizing tax-advantaged accounts like HSAs (Health Savings Accounts) or 529 plans for education savings can provide significant tax benefits while helping individuals achieve their financial goals. Additionally, keeping accurate records of income and expenses throughout the year can simplify the tax filing process and ensure that all eligible deductions are claimed.

Engaging with a tax professional or utilizing reputable tax software can further enhance one’s understanding of tax obligations and opportunities.

Navigating Financial Resources and Tools for Students

In today’s digital age, numerous resources and tools are available to assist students in managing their finances effectively. Online budgeting apps like Mint or YNAB (You Need A Budget) allow users to track spending in real-time and set financial goals easily. These tools often provide insights into spending habits and help users identify areas where they can save money.

Additionally, many educational institutions offer financial literacy programs designed specifically for students. These programs may cover topics such as budgeting, managing student loans, understanding credit scores, and investing basics. Participating in workshops or seminars can equip students with valuable knowledge that will serve them well throughout their lives.

Furthermore, seeking advice from financial advisors or mentors can provide personalized guidance tailored to individual circumstances.

Building a Strong Financial Foundation for the Future

Establishing a strong financial foundation is essential for achieving long-term stability and success. This foundation begins with cultivating healthy financial habits early on—such as budgeting regularly, saving consistently, and investing wisely—that will carry into adulthood. By prioritizing these practices from a young age, individuals can develop a mindset geared toward financial responsibility.

Moreover, continuous education about personal finance is vital in an ever-changing economic landscape. Staying informed about new investment opportunities, changes in tax laws, or shifts in the job market can empower individuals to make proactive decisions regarding their finances. Engaging with reputable financial literature, attending workshops, or following trusted financial experts online can enhance one’s understanding of personal finance concepts over time.

Ultimately, building a strong financial foundation requires commitment and ongoing effort but pays dividends in terms of security and peace of mind in the future.

FAQs

What is personal finance for students?

Personal finance for students refers to the management of money and financial decisions made by students to support their education and lifestyle. It includes budgeting, saving, investing, and managing debt.

Why is personal finance important for students?

Personal finance is important for students as it helps them develop good money management habits, avoid debt, and prepare for their future financial goals. It also teaches them the value of money and the importance of making informed financial decisions.

What are some key personal finance tips for students?

Some key personal finance tips for students include creating a budget, tracking expenses, saving money regularly, avoiding unnecessary debt, and seeking financial education and advice.

How can students save money and manage their expenses?

Students can save money and manage their expenses by creating a budget, cutting unnecessary expenses, using student discounts, finding part-time work, and being mindful of their spending habits.

What are some common financial challenges faced by students?

Some common financial challenges faced by students include managing student loans, balancing education and work, dealing with unexpected expenses, and learning to live within a limited budget.

Where can students find resources for financial education and advice?

Students can find resources for financial education and advice through their school’s financial aid office, online financial literacy courses, personal finance books, and seeking guidance from financial professionals or mentors.